Will A Weak Rupee Help Or Hurt Bangalore?

They say if the rupee appreciates, it will be because of more foreign investment, not more exports. Bangalore will benefit with investment but only if we remain an attractive destination for foreign investment.

Feb 20, 2021, 18 55 | Updated: Feb 20, 2021, 18 55

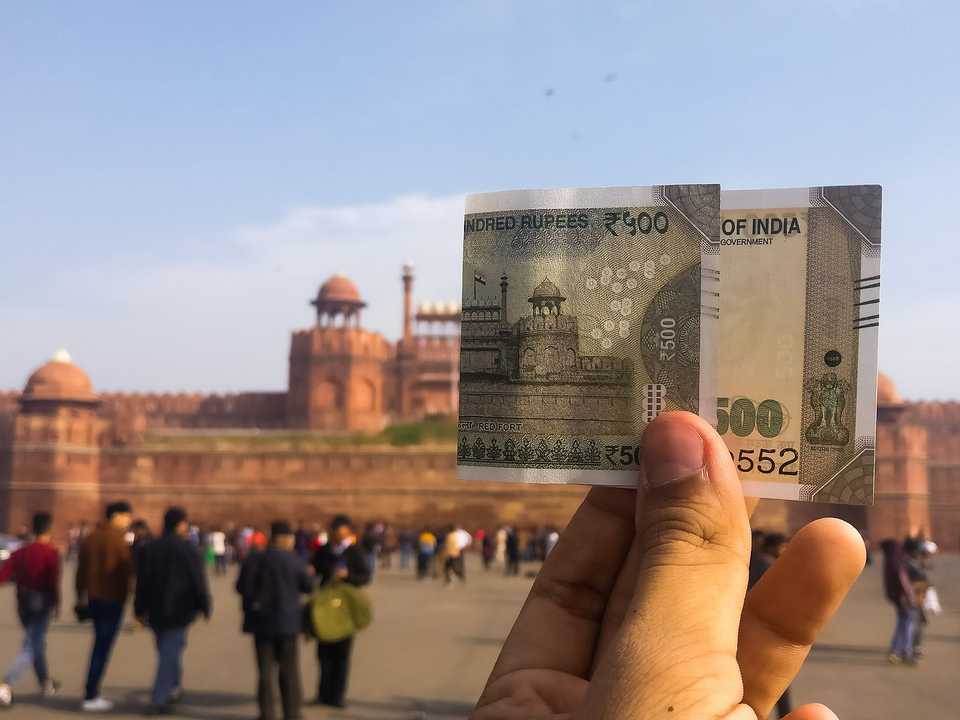

On August 15, 1947 the rate was $1=Re 1.

Almost exactly 66 years later, the rate is $1=Rs 62.

Is this good or bad? Aren't we better off today than we were in 1947?

So, what's a "good" value for the rupee?

In the last month, many of us have been trying to get our head around the erosion of the rupee against the dollar. The subject is confusing and so the press has been asking several industry and financial experts for opinions and clarity.

NASSCOM head Som Mittal told a CNN-IBN reporter, “I don't think a weak rupee is good for the economy. But then there is problem with a strong rupee as well. So there should be a balance.”

Gee thanks.

That clears up everything.

(I would ask that reporter to Youtube the episode of 'Da Ali G' where he asks top US economist Charles Schultze to recommend a "good" PIN number for his bankcard. The comedian, playing a moronic hip-hop wannabe, twits an advisor to presidents.)

Whether or not Mittal’s ambiguous statement was reported out of context, what does "balance" mean?

There's no managing price in a dynamic, free market. Supply and demand will dictate the value of a commodity.

Yet, the feeling among some I spoke with - many of them experienced businessmen, who know who put the BS in Balance Sheet - was that the central bank must defend the rupee.

But asking the government to step in is a bit like running crying to mummy every time the playground bully pushed you. While the RBI can spasmodically sell dollars to buy rupees - creating a demand for the rupee and driving up its price - it cannot do this forever.

So, is the answer to leave things be and let the rupee find its feet?

Not everyone is clear about why they are upset, but lots of people seem to think that a depreciating rupee is a bad thing. They believe that a weak rupee means a weak economy.

In a sense they’re right. A weak rupee means petrol prices go up and that causes all round price increases. All foreign products become more expensive… just as we were getting addicted to Tong’s Seaweed and Wasabi Cashews. Damn.

In another sense, a weak rupee means products made in India become cheaper and this helps exporters. But experts say that made in India products have a limited demand. Then governor of the RBI, Subbarao said that a falling rupee would not by itself help grow exports.

But a cheaper rupee has another attraction. It makes real estate prices cheaper and NRIs send money home to buy apartments. So, the building trade booms.

It also makes software cheaper and unlike manufacturing, that industry also benefits.

Importantly, a cheap rupee also makes investment more attractive.

International investors will look to India to get great deals and move vast amount of money in, to invest in stocks of existing companies, make acquisitions of start-ups like RedBus and also fund new companies.

The experts seem to agree that the only chance for appreciation and stability of the rupee is if there are sustained capital inflows from investors.

This happened before.

While our currency went down - from $1=Rs 10 in 1984 to Rs 15 in 1989 to about Rs 25 in 1993 to Rs 50 in 2006 to over Rs 60 now in 2013 - right through the Aughts (2000-2009) the rupee had a period of stability – it hovered in the 40s. In fact, it appreciated briefly against the dollar.

This happened despite the fact that we had high inflation and no improvement in our negative balance of trade. How come? Why was the rupee in that blissful plateau? Investment. Foreign inflows. We got about $8 billion in 2004 and about $17 billion by 2007.

Enter our fair city.

There’s a reason why Bangalore rocks - other than the weather.

Here in Bangalore, we don’t really give a hoot if Indian manufacturing sucks.

We are a "knowledge city". We don’t make great ball bearings but we have most of the software business in India and we rock KPO. And we heart entrepreneurs - people with good ideas set up shop here; our society encourages and applauds them.

And that's the happy for us Bangaloreans - when the weak rupee attracts foreign investments, we could be first in line to receive this investment.

In good periods during the last 10 years, Bangalore attracted foreign investments worth almost $10 billion. If it happens again, such a boost to the local economy would mean local businesses become more profitable and that in turn means an immediate uptick in job creation, better salary prospects – more pie to share and bigger pieces for all.

And here’s how we can totally f&*@ it up – by making Bangalore an unattractive city in which to live.

We can strew garbage all around the garbage bins, dig up the sidewalks, violate zoning laws and blame the corporation. We can drive higgledy-piggledy like all over the lanes, ignore pedestrians, kill cyclists, stuff 12 children into an autorickshaw meant for two and then blame the traffic cops for not doing enough.

And we can elect people to office who will protect Indian culture from the danger of rock music in pubs.

And from international investors who ask for a little lifestyle in return for believing in the economy of Bangalore.

------------------------------------------------------------------------------------------

Ramjee Chandran is Editor-in-Chief and MD of Explocity.

rc@explocity.com (E-mail)

@ramjeechandran on Twitter

Pic credit: Waitforyuvi - Own work on Wikimedia